When it comes to finding the Best Health Insurances Near Me: How to Find Reliable Coverage, readers are in for a treat with this captivating opening that promises a wealth of valuable insights and information. Dive into a world of health insurance options and tips that will surely guide you towards making informed decisions for your coverage needs.

The following paragraph elaborates on the topic, providing a comprehensive overview of important aspects to consider.

Choosing a local health insurance provider can offer several benefits, including personalized customer service, a better understanding of local healthcare systems, and potentially lower costs compared to larger national companies. Here are some popular health insurance companies in your area and experiences shared by individuals who have used local health insurance providers.

Choosing a local health insurance provider can offer several benefits, including personalized customer service, a better understanding of local healthcare systems, and potentially lower costs compared to larger national companies. Here are some popular health insurance companies in your area and experiences shared by individuals who have used local health insurance providers.

Researching Health Insurances

Researching different health insurance options is crucial to finding the best coverage that meets your needs and budget. Here are some tips on how to effectively research health insurance providers and plans:Where to Start Looking for Health Insurance Providers

- Begin your search by checking with your employer to see if they offer health insurance benefits. Many employers provide group health insurance plans that can be more affordable than individual plans.

- Explore the Health Insurance Marketplace, either through Healthcare.gov or your state's marketplace website, to compare different plans and prices.

- Consider contacting insurance brokers or agents who can help you navigate through various health insurance options and provide personalized recommendations.

- Look into Medicaid and CHIP programs if you qualify based on your income level, as they offer low-cost or free health coverage.

Key Factors to Consider When Comparing Health Insurance Plans

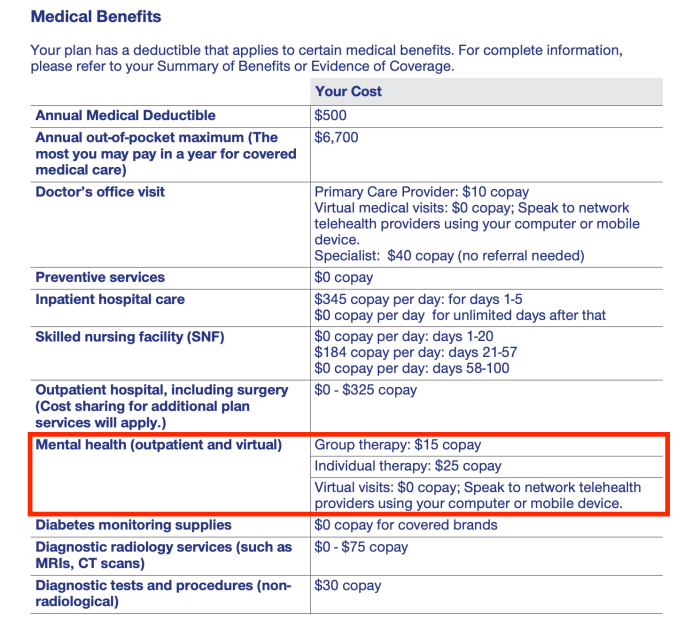

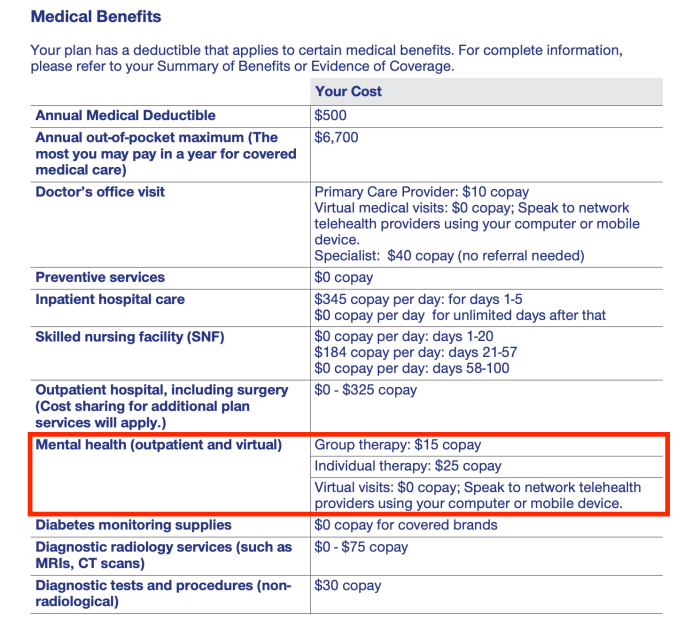

- Monthly Premiums: Compare the monthly cost of each plan to ensure it fits within your budget.

- Coverage and Benefits: Review what services are covered, such as doctor visits, prescription medications, hospital stays, and preventive care.

- Out-of-Pocket Costs: Consider factors like deductibles, copayments, and coinsurance to understand your financial responsibility for healthcare services.

- Network of Providers: Check if your preferred doctors, hospitals, and specialists are included in the plan's network to ensure you can receive care from them.

- Prescription Drug Coverage: Evaluate the plan's formulary to see if your medications are covered and at what cost.

- Customer Reviews and Ratings: Research the reputation of the insurance company by reading reviews and ratings from current or past customers to gauge their satisfaction levels.

Local Health Insurance Providers

Choosing a local health insurance provider can offer several benefits, including personalized customer service, a better understanding of local healthcare systems, and potentially lower costs compared to larger national companies. Here are some popular health insurance companies in your area and experiences shared by individuals who have used local health insurance providers.

Choosing a local health insurance provider can offer several benefits, including personalized customer service, a better understanding of local healthcare systems, and potentially lower costs compared to larger national companies. Here are some popular health insurance companies in your area and experiences shared by individuals who have used local health insurance providers.

Popular Health Insurance Companies in Your Area

- ABC Health Insurance: Known for its comprehensive coverage options and excellent customer service.

- XYZ Health Insurance: Offers affordable plans with a wide network of healthcare providers.

- 123 Health Insurance: Specializes in tailored insurance plans to meet individual needs.

Experiences with Local Health Insurance Providers

"I have been with ABC Health Insurance for several years now, and I have always been impressed with their quick responses and willingness to help navigate the complex healthcare system."

"I switched to XYZ Health Insurance last year, and I have been pleasantly surprised by their transparent pricing and easy claim process. It's reassuring to know that they understand the local healthcare landscape well."

"123 Health Insurance worked with me to create a customized plan that fit my budget and specific health needs. Their attention to detail and personalized approach really set them apart from other providers I've used in the past."

Understanding Coverage Options

When it comes to health insurance, understanding your coverage options is crucial for making informed decisions about your healthcare. Different types of health insurance plans offer varying levels of coverage, so it's important to know the specifics of each plan before choosing one that best suits your needs.Health insurance coverage can generally be categorized into three main types: Health Maintenance Organizations (HMOs), Preferred Provider Organizations (PPOs), and high-deductible plans. Each type has its own set of features and benefits, so let's take a closer look at what they offer:Health Maintenance Organizations (HMOs)

- HMOs typically require you to choose a primary care physician (PCP) who will coordinate all of your healthcare needs.

- Referrals from your PCP are usually necessary to see specialists or receive certain medical services.

- Out-of-network care is not covered, except in emergencies.

- HMOs often have lower out-of-pocket costs and premiums compared to other types of plans.

Preferred Provider Organizations (PPOs)

- PPOs offer more flexibility in choosing healthcare providers, allowing you to see specialists without a referral.

- You can receive partial coverage for out-of-network care, but at a higher cost compared to in-network providers.

- Monthly premiums and out-of-pocket costs are usually higher than HMOs, but you have more freedom to select healthcare providers.

- There is typically no requirement to choose a primary care physician.

High-Deductible Plans

- High-deductible plans have lower monthly premiums but higher deductibles, meaning you'll have to pay more out of pocket before insurance coverage kicks in.

- These plans are often paired with Health Savings Accounts (HSAs) to help cover out-of-pocket expenses with pre-tax dollars.

- Preventive care is usually covered before meeting the deductible, but other services may require you to pay the full cost until you reach the deductible.

- High-deductible plans can be a good option for those who are generally healthy and don't anticipate needing frequent medical care.

Evaluating Reliability and Reputation

When choosing a health insurance provider, it is crucial to assess their reliability and reputation to ensure you receive the best coverage and service possible.Strategies for Assessing Reliability

- Check the financial stability of the insurance company by reviewing their credit ratings and financial reports.

- Research the company's history of claims processing and customer service to gauge their reliability in handling medical expenses.

- Look for reviews and ratings from current and past customers to get a sense of the overall satisfaction level with the provider.

Significance of Checking Reputation and Customer Satisfaction

- By checking the reputation of health insurance companies, you can determine if they have a track record of fulfilling their promises and providing quality care.

- Customer satisfaction is crucial as it reflects how well the insurance company responds to the needs and concerns of its policyholders.

- Positive reviews and high ratings can indicate that the company is reliable and trustworthy in providing healthcare coverage.

Resources for Determining Reliability

- Use websites like J.D. Power and Consumer Reports to access ratings and reviews of health insurance providers.

- Consult your state's insurance department website to verify the licensing and complaint history of the insurance company you are considering.

- Ask for recommendations from friends, family, or healthcare providers who have experience with different insurance companies to gather firsthand insights.